It’s not uncommon for business owners to feel like they’re floundering despite paying top-notch accountancy fees. So do you need a bookkeeper if you have an accountant?

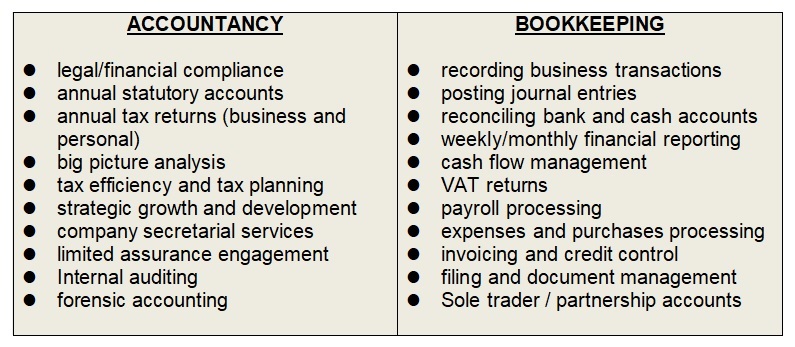

To answer this question you need to understand the difference between accountancy and bookkeeping.

Accountancy

Accountants are concerned primarily with making your business legally compliant, and they focus naturally on the bigger picture. They’ll examine a whole year’s worth of your transactions and use this data to prepare your annual accounts and file your tax return, for example.

Your accountant might also compare this data to that of previous years. Identifying any internal/external trends, offering planning suggestions to maximise your tax efficiency and your opportunities for investment and long term development. However, if you want this kind of strategic business advice you normally have to ask for it and be prepared to pay a premium

Bookkeeping

Bookkeepers focus on the details of your business. Record your transactions accurately. Help you make informed decisions with up-to-the-minute financial reports that give a true reflection of your profitability.

Bookkeepers will normally arrange payments to your suppliers. Identify/chase any outstanding customer invoices. Reconcile your bank accounts. File VAT returns and administer your payroll. Help you with cash flow management, short term development planning and routine tax matters.

A bookkeeper can also reduce your annual accountancy bill by liaising with your accountant. Minimizing the time that would otherwise be spent on correcting your recording errors and other routine bookkeeping.

Sole trader or in a partnership

If you’re a sole trader or in a partnership, a good bookkeeper could probably meet all of your accounting requirements without the premium price that an accountancy firm would charge.

Running a small to medium sized company

If you’re running a limited company you’ll almost certainly need an accountancy firm for filing accounts/tax returns that are compliant with HMRC and Companies House regulations.

However, as already noted, accountants don’t normally get involved with the day to day running of a business, and will most likely charge a premium price for bookkeeping services. A small to medium-sized business is likely to be better off hiring an accountant and a bookkeeper who compliment each other and collaborate to give you the best possible service.

Need a little help?

My Accounting Emails are for business owners who want a better understanding of their financial position. They’ll help you manage your cash flow and stay in the black.

GET MY EMAILS

Need more help?

Contact me today and we’ll talk about the help you need.

CONTACT ME

“As a small business it is important to always have financial clarity and often it is difficult to try and do this yourself. Paul has worked with us for several years and has streamlined and organised all of our accounting systems. He provides us with a complete accountancy service and is very professional in his approach as well as being a likeable guy.” - D. Walsh, Director. DualTEC Services Limited, Keighley. (Google review)

“Paul has done a great job putting my accounts on to Sage Business Cloud, and also got a discount for me. I like that the software is MTD compatible and I can access it from anywhere. Paul sorts out all my invoices, does my bookkeeping and produces reports every quarter (or whenever I need them). He is friendly, reliable and easy to work with - it's good to have him on board." - C. Milne, Proprietor. CAM Properties, Carnforth. (Google review)