Making Tax Digital (MTD) is part of the Government’s plan to make the UK tax system “more effective, more efficient, easier for taxpayers to get their tax right”. The main points to note are:

- From 1 April 2019, VAT-registered businesses with a taxable turnover above the VAT threshold of £85,000 must keep their VAT records in digital form.

- They will have to submit their VAT returns using third party accounting software. Submitting manually through the post or online using the Government Gateway will no longer be allowed.

- MTD will not be mandated for other taxes until at least April 2020.

MTD Compliance

To comply with MTD business will need to:

- Create a Making Tax Digital account with HMRC

- Buy MTD ready commercial accounting software

- Use this software to keep digital tax records and submit tax returns

MTD Pilot for VAT

If you are a sole trader, or you currently submit the VAT Return for a limited company, you may be able to join the Making Tax Digital pilot for VAT. Doing so now could give you a head start on complying with the new system before it becomes compulsory on 1 April 2019.

MTD Software

HMRC have published a list of commercial suppliers who are now supporting the pilot with MTD compatible software, or developing software that will be suitable for sending VAT Returns when MTD becomes mandatory in April 2019.

MTD Digital Records

The MTD requirements for VAT digital record keeping are as follows:

- business name, address, VAT registration number, details of any VAT accounting schemes used

- For each sale, the time of sale (tax point), the net value, the rate of VAT charged

- For each supply, time of supply (tax point), the amount of irrecoverable VAT, the amount of recoverable VAT.

- The totals for any adjustments made in accordance with VAT rules, but not the details of the underlying calculations.

MTD Digital Links

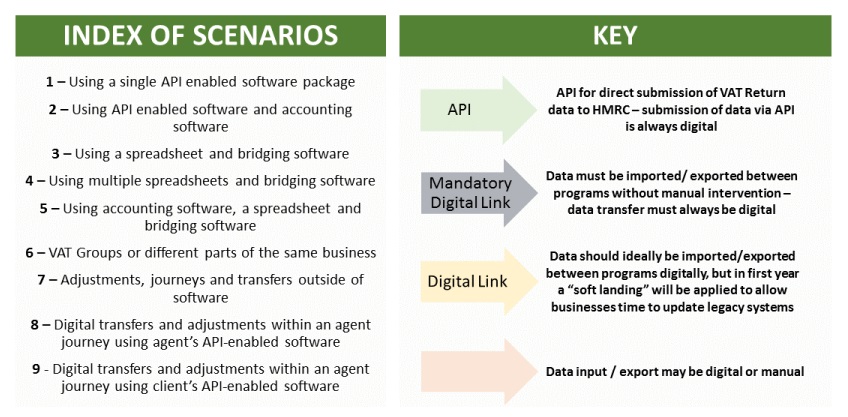

Digital records do not have to be held in one place or programme, however from 1 April 2020 there must be a digital link between the pieces of software used. Transferring data manually within or between the different software programs, products or applications isn’t acceptable under MTD. Transfering, recapturing, or modifying data must be done using digital links. The image below illustrates the most likely digital record keeping and reporting options that businesses will have.

MTD Penalties

In December 2017 the Government published details of its proposed points-based penalty system for late submissions and payments under MTD.

- A business will receive a point every time it fails to submit on time.

- When a certain threshold (determined by the frequency of obligatory submissions) is reached, the business will incur a penalty for every subsequent submission failure.

- Points will be reset to zero after “a good compliance period” (again determined by the frequency of obligatory tax submissions).

- Although MTD for VAT will start after 1 April 2019, the new model of penalty points for late VAT returns will not be applied before 2020.

MTD Criticism

A recently published House of Lords Economic Affairs Finance Bill Sub-Committee report found that HMRC had failed to adequately support small businesses with the introduction of MTD. HMRC, taxpayers, and the software market were said to be unprepared for the implementation of MTD for VAT in April 2019. The report recommended a delay of at least one year.

HMRC has published a Stakeholder Communications Pack containing more information about MTD for businesses.

Need a little help?

My accounting emails are for business owners who want a better understanding of their financial position. They’ll help you manage your cash flow and stay in the black.

FIND OUT MORE

Related post – To Register or Not Register? VAT Is The Question